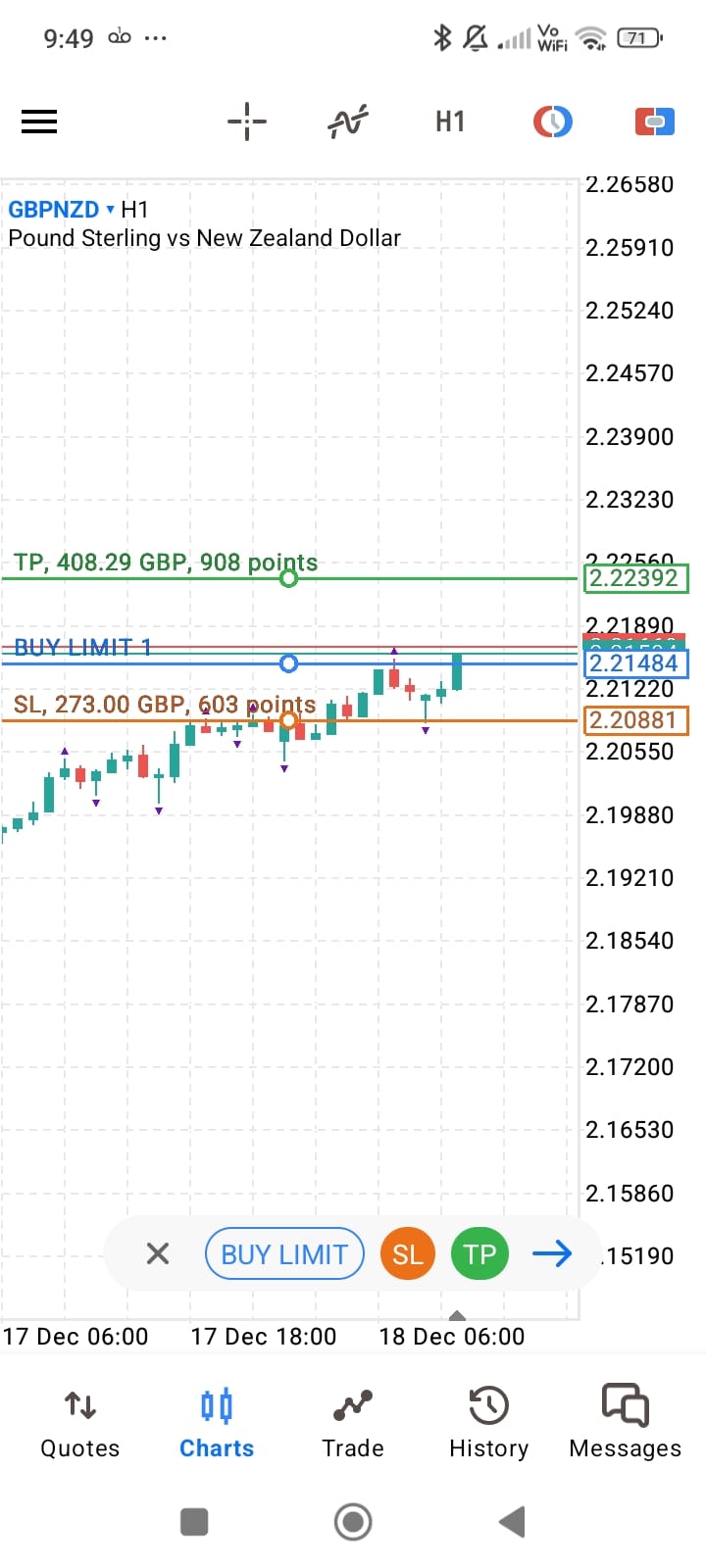

Trade photo

GBP NZD has a high ATR, so it's a 60 pip stop loss with 90 pip profit target. The trade is based on the potential of UK rates remaining higher for longer compared the NZD. Negative china news has compounded NZD weakness and sent it below that 4hr USD support I mention yesterday.

I will take tee trade off before the FOMC if it's still running. The risk to the trade is quiet pre FOMC trading, or a switch to a 'strong risk on' narrative.